KTC cancels inactive credit cards

Krungthai Card has cancelled about 40,000 inactive credit cards to cut operating costs.

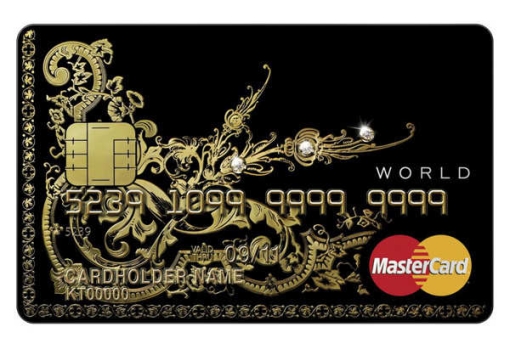

This include service fees for payment systems to Visa International (Thailand) and MasterCard Thailand. By doing so, it can cut the number of cards held by the same person to an average of two from three before.

Rathian Srimongkol, the president and chief executive, said KTC plans to clear up inactive cards by charging an annual fee of 500 baht per card or the card will be revoked.

The fee applies to new applicants from March 1 this year.

The company's card base will still be about 1.6 million due to new card applications.

Credit card spending has grown by 8-10% this year due to promotional campaigns and card benefits.

Spending via KTC cards is about 10 billion baht a month, helping company earnings.

"We expect to announce a net profit for the second quarter after booking net losses the previous two quarters. The company's cost-to-income ratio has also improved due to several cost-cutting strategies," said Mr Rathian.

Mr Rathian said KTC will reduce the number of outsourcing companies for both marketing and debt collection to only five from nearly 20 now.

Mr Rathian said this method should improve collection, control operating expenses and strengthen staff productivity.

KTC has the Thailand's largest credit card base and plans to reduce its cost-to-income ratio to 40% in 2015 from 46%.

For more.

Advertise

Advertise