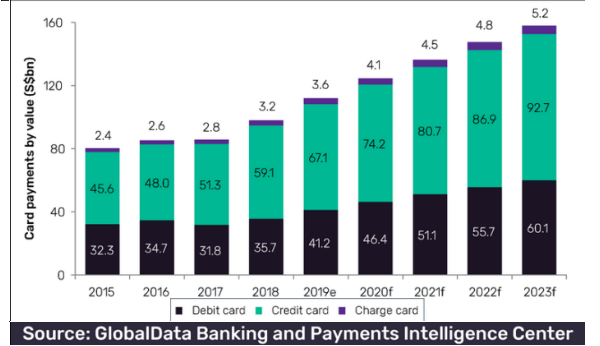

Singapore card payments market to hit $158b in 2023

Credit cards took the lion’s share in market value at 60% in 2019.

Singapore’s card payments market is set to reach $158b (US$116b) in 2023 from S111.9b (US$82.1b) in 2019, according to a GlobalData report.

The government’s cashless efforts alongside rising consumer awareness and a better payment structure spurred growth, with the average Singaporean holding more than three cards.

Credit cards led the market share by value at 60% in 2019 with a strong CAGR of 10.1% from 2015 to 2019, mainly driven by pricing benefits and value added services, said GlobalData banking and payments analyst Nikhil Reddy.

The rising adoption of contactless cards will further propel the shift to a cashless society, GlobalData added. From April 2019, the Land Transport Authority allowed contactless payments at MRT or bus rides using Mastercard credit and debit cards, later extending the service to Visa cardholders in June, and to Network for Electronic Transfers (NETS) cardholders in November.

Advertise

Advertise