Cards & Payments

UOB launches QR-code payments for cash-on-delivery

It aims to reduce fraud risks for corporates, of which two-thirds still receive cash from buyers.

UOB launches QR-code payments for cash-on-delivery

It aims to reduce fraud risks for corporates, of which two-thirds still receive cash from buyers.

Bank of East Asia forges digital banking partnership with five firms

Customers can apply for loans and purchase products online in these platforms.

RuPay ends Mastercard and Visa duopoly in India

The number of debit cards issued hit 605.3 million.

Philippines pushes for national QR code standard

The National Quick Response (QR) Code Standard aims to boost financial inclusion.

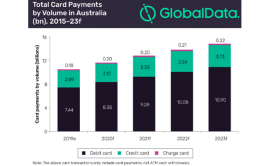

Australian contactless cards to hit nearly 70 billion by 2023 as cash loses luster

The number grew at a CAGR of 12.7% from 2015-19.

Monthly transactions in PayNow cross $1b mark

Over 3 million in combined mobile and NRIC numbers are registered to the service.

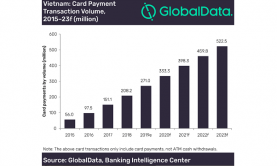

Card payments in Vietnam to hit over 522 million in 2023

The number of card payments have already rose more than fivefold in 2015-2019.

Cards to reign supreme in South Korea as cash loses appeal

By 2020, cards will emerge as the dominant payment instrument.

Learn how virtual banks can ease onboarding processes for SMEs

Hear from CH&Co's Guillaume Rico at ABF DOB Conference on how banks can stay ahead.

Asian banks race against time to shake up payments scene

The rise of virtual banks is intensifying competition in an already crowded arena.

DBS plans foray into India's credit card space: report

The bank aims to launch credit card services by Q3 2020.

Digital financial services in Japan: What digital consumers want

Digital innovation initiatives are gathering speed at financial institutions around the world. This was made further evident by the Celent Model Bank...

Credit card spend in Taiwan hits $10.42b in June

The tax season drove monthly gains.

OCBC enables cash withdrawals via QR code

Cash withdrawal at ATMs can be completed in under 45 seconds.

Citi Hong Kong launches payment settlement feature Citi PayAll

Credit cardholders can settle one-off or recurring payments on the app whilst earning points.

Japan Kicks Off Reiwa Era's Payment Infrastructure, Part 2: BOJ-NET

The first section of this two-part commentary was published here.

Weekly Global News Wrap Up: Credit Suisse to sell B2B investment fund platform; Citi kills some card perks

And German banks could face $695m over dividend tax concerns.

Advertise

Advertise