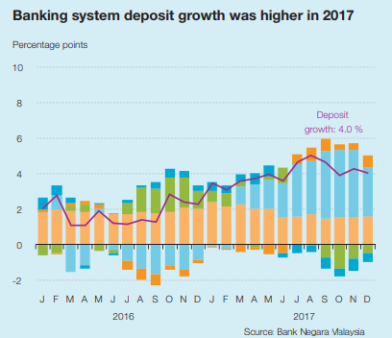

Chart of the Week: Check out the composition of Malaysian bank deposits from 2016 to 2017

Deposits grew 4% YoY in 2017.

The liquidity in Malaysia's overall banking system remained robust which supported the financial intermediation process, according to Bank of Negara Malaysia as deposits grew 4% YoY in 2017. At the system level, aggregate outstanding liquidity placed with the Bank increased following capital inflows since Q2. At the institutional level, most banking institutions continued to maintain surplus liquidity positions.

Throughout the year, the Bank’s monetary operations remained focused on maintaining stability in the interbank market.

Here's more from Bank Negara Malaysia:

In the first quarter of the year, the slight moderation in domestic liquidity arising from capital outflows were offset by liquidity injection operations through the reverse repo and foreign exchange swap facilities. Following the resumption of capital infl ows from the second quarter onwards, the Bank was able to reduce its liquidity injection operations. Subsequently, activity in the domestic money market remained uninterrupted during the year.

Private sector liquidity, as measured by broad money (M3), grew at a much faster pace of 4.7% in 2017 (2016: 3.1%). The expansion in M3 continued to be supported by the extension of credit by banks to the private sector in the form of both loans and the purchase of corporate bonds. Total deposits in the banking system also recorded a higher annual growth rate of 4.0%, mainly due to a turnaround in deposits placed by businesses, which grew by 7.9% in 2017 (2016: -2.3%). Household deposit growth, however, moderated to 3.9% (2016: 5.1%) during the period.

Advertise

Advertise