Why the bank of the future is not really a bank

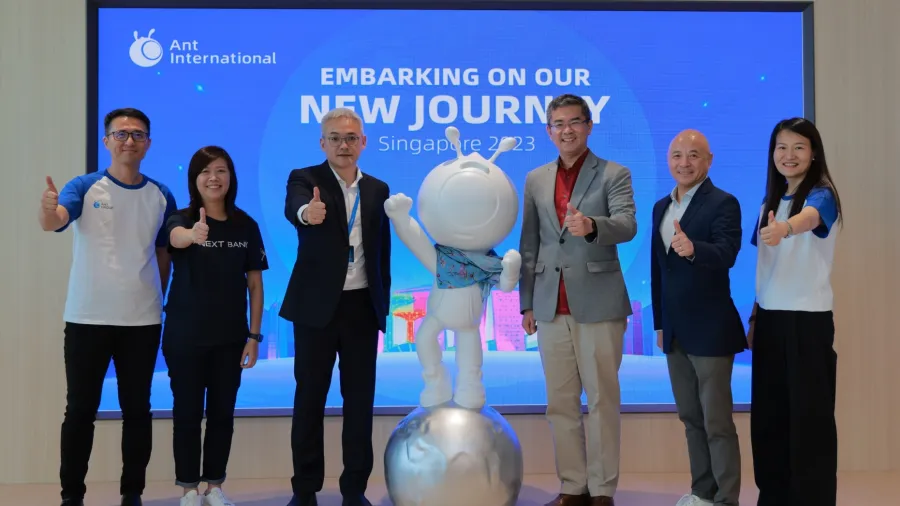

ANEXT Bank’s Toh Su Mei reveals how they are reimagining banking for small and medium enterprises.

One year after kicking off operations as a full-fledged digital bank, ANEXT Bank CEO Toh Su Mei shared one of her key takeaways on Singaporeans’ modern banking needs: “Nobody needs another bank in this day and age!”

Pushing this premise when interviewed by Asian Banking & Finance, she added: “Which is why we were very clear from the onset on why we do what we do and how [we do it].”

In the past year, ANEXT Bank has been embarking on discovering the best way to service Singapore’s underserved small and medium enterprises (SMEs). For loans up to S$30,000 (US$22,200), no additional documents will be required for SMEs, enabling them to meet their liquidity needs in an easier way.

ANEXT is also the first bank in Singapore to offer remote virtual onboarding for business owners who are based overseas but have registered businesses in Singapore, reducing the need to travel into the city to set up shop.

Toh cited their target market, the SMEs, as an inspiration and called them a reflection of what the bank strives to serve.

“We serve businesses from industries as well as individuals that are typically not digital-first. Our youngest customer is 19 years old, whilst our oldest is 86,” Toh said, noting that this diversity in ages shows the impact of what customer-driven and tech-led financial services can make.

This is also why ANEXT Bank remains optimistic in its ability to enable financial inclusion for the long term. Dwelling on this enthusiasm, Asian Banking & Finance got its CEO to open up about more interesting insights on the future of banking.

How have things been on ANEXT Bank, one year on? What have you achieved over the past year?

At ANEXT Bank, we have a big, hairy audacious goal to reimagine financial services for financial inclusion — we believe in establishing the essentials that stay true to our mission, and to do them well. We’re encouraged by the trust that SMEs have placed in us this past year. About 65% of SMEs who have chosen us to be part of their journey are micro businesses, whilst 33% have businesses incorporated for less than two years; [and] 30% of our customers are foreign business owners who have incorporated a business in Singapore. Our customers are also showing a 20% month-on-month increase in cross border transactions.

Over 6 in 10 of your customers are micro businesses. Why do you think you became the bank of choice for micro businesses?

Regardless of business set up, size and vintage, there are common areas or challenges they all face when it comes to financing and banking, which is the gap we aim to fill for them — whether it’s banking directly with us or through embedded financing from our partners.

We are committed to building an open ecosystem and working with financial institutions and industry partners to drive industrial transformation and even more value for these partners. The ANEXT Programme for Industry Specialists (APIs) is an example of our open approach, to improve and scale embedded finance for SMEs by making it easier for businesses to access financing through our industry collaborations. Through our initial two partners, we can serve close to 15,000 SMEs collectively, supporting them with easier and more seamless access to their financing needs.

Any notable trends you observed in Singapore’s banking sector?

The banking and finance industry, like many other industries, has seen an accelerated shift towards digitalisation, including the issuance of digital banking licenses as another indication towards championing digital-first behaviours. Small businesses account for more than 85% of cross-border e-commerce in the Asia Pacific region and digital trade is expected to further accelerate in tandem with higher consumer adoption of digital lifestyles.

It’s no surprise that Singapore has a highly banked population, but studies have shown that SMEs are still underserved by the country’s banking sector. According to Deloitte, 72% of SMEs require funds to better manage their working capital and mitigate cash flow problems. At the same time, local governments and industry players are building ecosystems and digital infrastructure to support SMEs’ digitalisation.

We are not here to compete with incumbents, but to provide SMEs with an additional choice to cater to different needs. For example, lowering the barriers of entry for micro businesses — whether it’s to kickstart their business or to test new markets’ response to their services — by omitting any set-up costs when it comes to opening and maintaining a bank account with us.

Are there any future plans you would like to share with our readers? What can Singapore’s MSMEs expect from ANEXT Bank over the next couple of years?

We continue to be laser-focused and committed to addressing the needs of MSMEs and SMEs in Singapore and the region. We’ll double down on our efforts to enable more effortless and accessible financial solutions to help them start or scale digitally, which includes exploring more partnerships through our API to avail financing on platforms where these SMEs and MSMEs are already doing business on.

At the same time, [we are] not forgetting to embrace a customer-first approach, combining human intelligence and intuition to innovate, not just for innovation’s sake, but instead as a guidance to optimise processes and enhance customer offerings and experience with these data insights.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise