Looking into CIMB Vietnam’s strategic partnerships in building digital finance ecosystem

The partnerships aim to innovate in banking products and services.

In 2019, CIMB Vietnam’s stakeholders believed and decided that entering into a partnership is its differentiated strategic development direction in order to achieve its targeted goals and build a digital financial ecosystem in Vietnam. Since then, it has been putting its heart and soul into developing strategic partnerships.

One of the most difficult, yet critical processes that decides the success of a partnership is the need to customise its product offerings based on the partners’ needs, digital capabilities, and nature of business.

After 3 years of efforts, it has successfully built innovative banking products and services that significantly increased its acquisition number and boosted financial inclusion in Vietnam. It is now partnering with three strategic partners through the efforts of CIMB Vietnam’s Partnership team.

These partners are F88, the largest financial services chain in Vietnam; Finhay, a leading digital investment platform, and; SmartPay, a digital wallet service for merchants and consumers.

The partnership with Finhay introduced a co-branded debit and credit card that can be opened and maintained straight from the Finhay app. This offers Finhay customers a seamless digital bank service and allows them to save and invest instantly with zero fee fund transfers and withdrawals between Finhay and CIMB accounts.

Meanwhile, F88 targets the unserved and underbanked customer segment. CIMB Vietnam offers them its first digital collateral-backed Personal Loan product in Vietnam with end-to-end straight through onboarding and disbursement into customers’ bank accounts.

CIMB and F88 shared the same objective which is to provide highly competitive professional financial solutions that are easy to access for vulnerable groups in society and eventually, promoting greater financial inclusion across Vietnam.

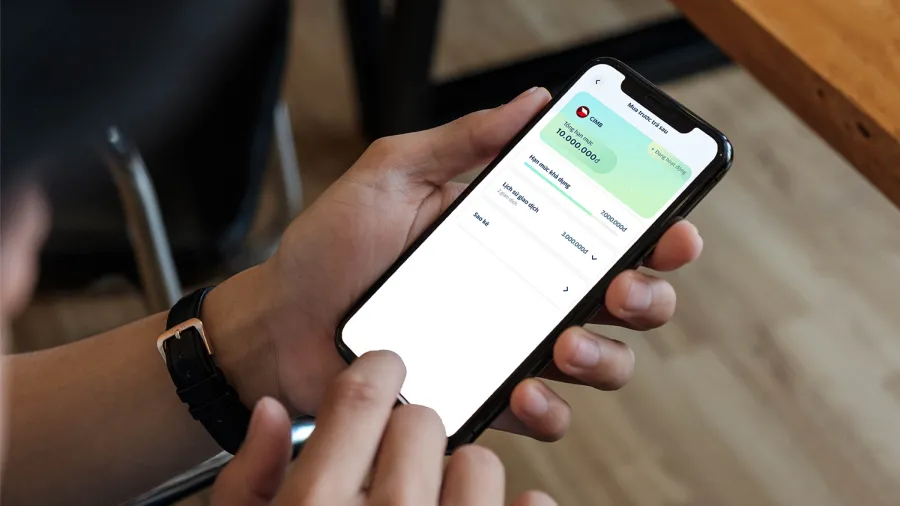

After the successful cooperation on the opening of CIMB’s Spend Account on the SmartPay platform, it is expanding CIMB Bank’s product offering with Buy-Now-pay-Later product. It is an innovative provision of digital financial services on an e-wallet for both consumers, micro merchants, SMEs and chain merchants via mobile platform.

This will help CIMB penetrate the SmartPay customer base with 2.3 million e-wallet consumers, over 540,000 micro and small merchants, and over 120,000 chain merchants in 63 provinces across Vietnam. It is expected that CIMB will reach 1.2 million new customers by the end of this year.

CIMB Vietnam’s successful partnerships and its improvements towards business goals have been recognised by the Asian Experience Awards, as it clinches the Vietnam Partner Experience of the Year - Banking award.

“We will keep this momentum going and are looking forward to a more inclusive and seamless digital financial ecosystem providing a better financial lifestyle for Vietnamese consumers,” the company said.

The prestigious awards programme aims to highlight the ingenious initiatives of creative companies delivering meaningful brand experiences to their stakeholders.

The Asian Experience Awards is presented by Asian Business Review Magazine. To view the full list of winners, click here. If you want to join the 2023 awards programme and be acclaimed for providing meaningful brand experiences to stakeholders, please contact Jane Patiag at [email protected].

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise