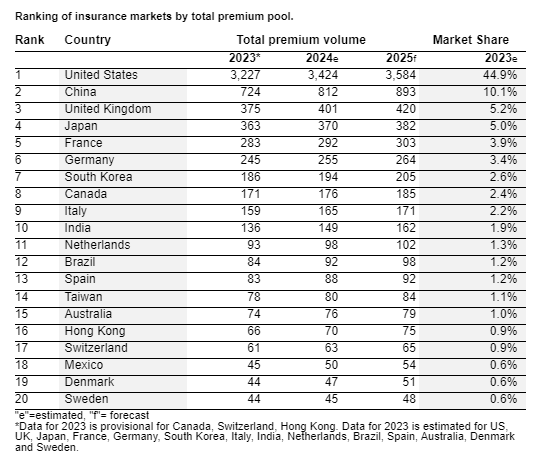

Advanced markets to drive half of new insurance premiums by 2034

Advanced APAC is expected to see strong growth in the life sector.

Despite geopolitical and inflationary concerns, advanced markets are anticipated to drive half of all additional premiums in the next 10 years, with increased premium and investment income boosting life sector profitability by 15% in 2024.

"The insurance industry has reached a new equilibrium after the challenges of recent years. The global economy has surprised on the upside, which should drive more demand for insurance. The life sector in particular is one to watch as higher interest rates drive investment income and consumer demand for annuities, giving more people secure retirement incomes,” Jérôme Haegeli, Swiss Re's Group chief economist, said in a press release.

/Swiss Re Institute's annual World Insurance sigma 2024.

Swiss Re Institute projects global GDP growth at 2.7% in real terms for 2024, matching 2023, with a slight increase to 2.8% in 2025.

The US is expected to grow at 2.5% in 2024, while the euro area will see a slower 0.7% growth, Swiss Re Institute's annual World Insurance sigma 2024 report unveiled.

Disinflation is ongoing, but returning to target inflation levels may be uneven. US inflation is anticipated to hit the target by 2025, whilst Europe is nearing its target due to falling energy prices, softer core prices, and slower wage growth.

For non-life insurance, profitability is set to improve. After rising rates due to inflation-driven claim costs, the Swiss Re Institute expects personal lines rates to remain high in 2024 but moderate in 2025.

Commercial lines will see slower rate increases and some market softening.

Non-life premium volume is projected to grow from $4.6t in 2024 to $4.8t in 2025, building on 2023's 3.9% growth.

Kera McDonald, Chief Underwriting Officer at Swiss Re Corporate Solutions, anticipates sustained profitability in commercial insurance and ongoing single-digit rate increases for property, though casualty markets are showing general softening.

Property and casualty insurers are expected to see improved profitability in 2024, with an industry-wide return on equity (ROE) rising to 10% from 6% in 2023, and forecasted to remain above 10% into 2025.

The life insurance sector is benefiting from higher interest rates, with Swiss Re Institute forecasting 2.9% premium growth to $3.0t by the end of 2024, and 2.7% growth in 2025.

Western Europe and advanced APAC are expected to see strong growth. Notably, annuity sales surged 63% in 2022 and 36% in 2023 in the US.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise