India strengthening Exim Bank

Adds US$517 million to finance exports of heavy industry goods.

India is boosting the capital of the Export-Import Bank of India by US$517 million to strengthen its lending ability and help finance exports of heavy industry goods. The government believes this can be a game changer for the economy in a year when capital inflows from abroad are the top priority for the government.

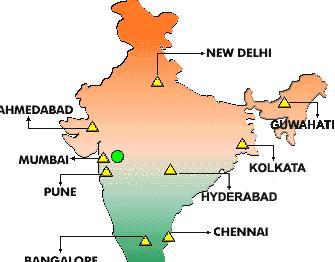

The move follows appeals from Bharat Heavy Electricals, Ltd (BHEL) that it is losing business abroad to competitors despite being price competitive because of lack of Exim Bank cover. BHEL is a state-owned integrated power plant equipment manufacturer and operates as an engineering and manufacturing company based in New Delhi.

Since its inception, Exim Bank has mostly worked as a support system for small and medium enterprises. It has hardly financed large scale project imports.

Projects of the sort BHEL wants to finance means it will need to borrow abroad, but its small capital base makes its loans costly. This means the cost of credit to BHEL and other Indian firms will price them out of the international markets dominated by the Chinese and US Exim Banks.

Advertise

Advertise